[PDF] Hiring Independent Contractors The Employers Legal Guide Working With Independent Contractors Ebook

Independent Contractor Canada

Hiring Independent Contractors The Employers Legal Guide

Independent Contractor Self Employed or Employee ... I am an independent contractor or in business for myself If you are a business owner or contractor who provides services to other businesses, then you are generally considered self-employed. For more information on your tax obligations if you are self-employed (an independent contractor), see our Self-Employed Tax Center. Hiring and Paying an Independent Contractor The contractor is, by definition, independent, and not an employee of the hiring company. A perfect example of an independent contractor is a cleaning service. The service comes into your office to do work, but the cleaning service workers are not employees of your company. Independent contractors are considered to be business owners. Independent Contractor or Employee? A Guide to California ... Independent contractors are workers who are in business for themselves. Theyre generally free to work on multiple projects at the same time, and take jobs on a freelance basis. In many cases, they can choose when, where, and how they perform the work.1. Employees are workers that are employed by a business, person, or government entity.2 In an employee-employer relationship, the employer ...

Hiring Independent Contractors The Employers Legal Guide

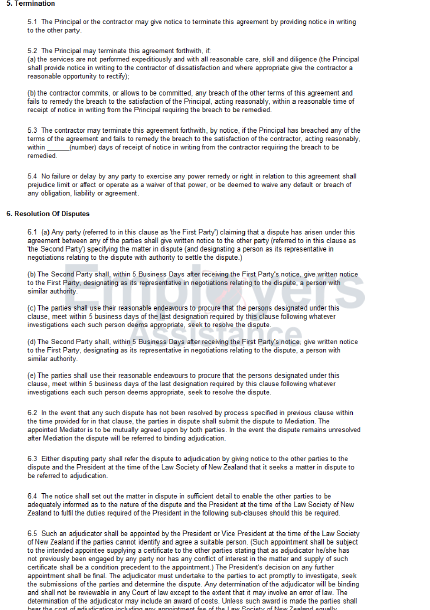

Workplace Hiring Lawgives

Hiring Independent Contractors The Employer S Legal Guide

Consultant Amp Independent Contractor Agreements Stephen

Independent Contractor Agreement Amp Guide Employers

0 Response to "Hiring Independent Contractors The Employers Legal Guide Working With Independent Contractors"

Post a Comment