[PDF] The Prudent Investment Adviser Rule Risk And Liability Management For Investment Fiduciaries Ebook

Rebecca Sczepanski Meeting Fiduciary Duties Reducing

Home Www Retirementsolutionservices Com

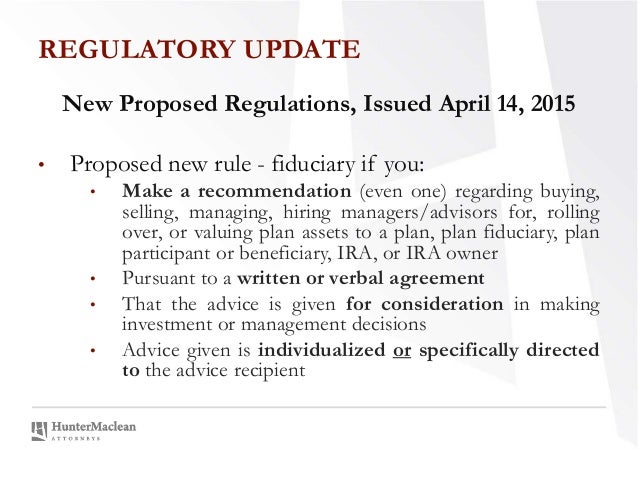

The Prudent Investment Fiduciary Rules Best Practices ... As an ERISA attorney and risk management consultant to a 401(k)/403(b) plans, my concern is that most plans are not aware of the liability exposure and challenges that they may face. ... The Prudent Investment Adviser Rules. Subscribe in a reader. ... The Prudent Investment Fiduciary Rules Create a free website or blog at WordPress.com. The ... ERISA and Modern Portfolio Theory Prudence Per Footnote ... As an ERISA attorney and compliance consultant, I often hear plan sponsors and service providers attempt to justify an imprudent investment option by claiming that they are simply complying with the DOL's and the courts' adoption of Modern Portfolio Theory (MPT) as the applicable standard for assessing the prudence of investments. Now that latter point Prudent Investor Rule - Investopedia - Sharper Insight ... The prudent investment rule requires a fiduciary to invest trust assets as if they were her or his own. This managing investor should consider the needs of the trust's beneficiaries such as a ...

0 Response to "The Prudent Investment Adviser Rule Risk And Liability Management For Investment Fiduciaries"

Post a Comment